A home for two frappes a day/engagement ring/ (insert insanely expensive gadget) only? We’ve all heard this pitch before. And naturally, of course, Filipinos are easily baited when condos and house and lots for sale are being pitched as if you can purchase them from a shelf at a department store (literally abot-kamay). But knowing how the homebuying process in the Philippines is, can a working-class Filipino really afford a home today?

Money Matters

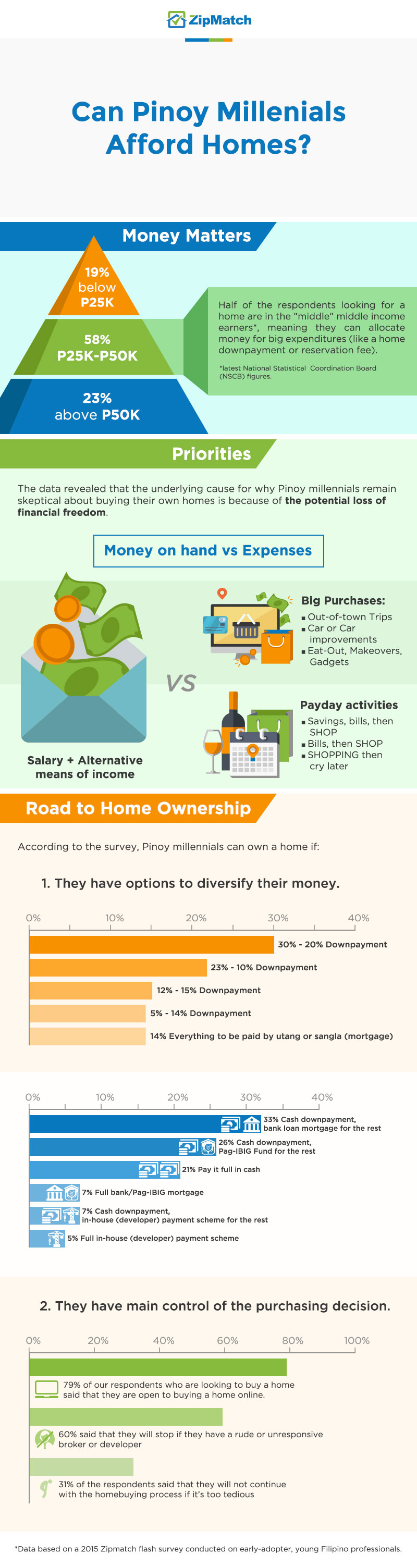

ZipMatch recently conducted a study on the reasons why Filipinos do not own a home yet. The study revealed that 32% were not confident about their financial capacity once they commit to buying a home. Although only 72% chose to divulge their salary range, 58% of them said that they earn salaries of 25,000php to 50,000 php, which is the income range of “middle” middle-income earners based on the latest National Statistical Coordination Board (NSCB) figures.

We decided to go deeper into a Pinoy millennial’s mindset about homebuying and asked the respondents who do not have their own homes about their spending habits. The data revealed that only 49% of them expressed their desire to buy a home. On the other hand, a the other 51% of the respondents said that they prefer to invest in personal leisure (e.g travel, gadgets, beauty makeovers) first before buying a home.

Priorities

Through our follow-up questions in the flash survey, the data revealed that the underlying cause for why Pinoy millennials remain skeptical about buying their own homes is because of the potential loss of financial freedom.

Below is an infographic based on the data from the survey:

When we asked the respondents to choose reasons that would stop them from continuing the homebuying process, the majority of our respondents expressed concern about not being able to fulfill their part of the home payments.

But upon looking at their financial activities come payday (which, in the Philippines, generally happens every 15th and 30th of each month), Pinoy millennials always include shopping as a necessary activity that comes first or follows after paying off bills.

The 12% who responded “Others” also listed that although they need to set aside money for significant expenses, a portion of their take-home pay can either be spent on family and friends, or for personal use (shopping).

So, is the Pinoy millennial kapos after every payday? When asked about the biggest expense that’s taking up their budget, Pinoy millennials appear to be struggling with knocking off the one expense on the list that could easily be an income or value-generating asset (Hint: it’s the one that’s ranked highest on the following list). Moreover, at least 41% of the expenses can actually be controlled or budgeted more strategically (household bills, leisure, credit card bills)

Moreover, the Pinoy millennial appears to never be kapos when it comes to money. 47% of the respondents say that they have other means of income aside from their primary employment. 30% of those who said that they have alternative means of income admit that they get money from freelance work. 35% of the respondents appear to have already made income-earning investments (savings account, financial investments, small businesses).

So what then drives a Pinoy millennial to divert from homebuying? We delve further into the Pinoy millennial’s shopping cart and found out that although a lot of them save up to 30% of their salaries, it may also mean that part of those savings are used to fund big items that are not necessarily income or value-generating investments or assets.

The Road to Home Ownership

Although 98% of the respondents consider a home as an investment, they feel the need to be conservative when it comes to investing their money in real estate. But the study reveals that the road to home ownership for Pinoy millennials can be a reality to them without sacrificing financial freedom.

1. Investment Flexibility

In finance, diversification is an investment strategy used by investors to yield high returns without incurring high risks of losing money. Based on the data from the study, the road to home ownership is not just about saving enough money for a downpayment, but having the option to diversify, or reduce the risk associated with putting most or all of their money in one (financial) basket.

When asked about how much can they can come up with for a home downpayment, 14% of the respondents said they do not want to shoulder the downpayment and prefer everything to be paid by utang or sangla (mortgage)

When the respondents were asked about their ideal home payment scheme, Pag-IBIG Fund and bank financing are the most preferred.

2. Control of Purchasing Decision

But the real push needed by Pinoy millennials to buy homes is having control of their homebuying decisions. For example, 79% of our respondents who are looking to buy a home said that they are open to buying a home online. If there’s one reason to support this response, it could be an overwhelming dislike of some of the traditional steps in the homebuying process.

Take the case of an overseas Filipino worker (OFW). For the OFW who is abroad earning the payments made on the home he wishes to buy, the decision-making process also involves the people who, at the surface, aids him in the homebuying process. But in reality, these people may not have the OFW’s true interests at heart: a family member who acts as his loan administrator, a broker who prioritizes his preferred projects for the sake of earning bigger commissions, or the bank that offers a certain variety of financing schemes limited to his earning power.

Although only 31% of the respondents said that they will not continue with the homebuying process if it’s too tedious, 60% said that they will stop if they have a rude or unresponsive broker or developer.

If these roadblocks are eased out, then we can see the influx of more Pinoy millennials making smart and confident home purchases.

Don’t know yet if you can afford to buy a home? Talk to a Concierge about your finance options by leaving a message via the chatbox on our website or via email at help@zipmatch.com.