What Is A Contract to Sell?

A Contract to Sell is a formal agreement between the seller and the home buyer. The document signifies that both parties agree with all the terms and conditions (selling price, payment schedule, and other expenses) of the home purchase.

When should a homebuyer receive a Contract to Sell?

The execution of this legal document appears to be a standard when buying real estate in the Philippines. This document is usually issued by the broker or the developer after the homebuyer has paid a cash deposit and has agreed to pay the remaining balance to the seller through agreed financing terms in good faith.

A homebuyer can demand a contract to sell even if he has yet to sign a home financing agreement with a lender (e.g. Pag-IBIG Fund, bank, developer). This is because certain banks, including Pag-IBIG, require this document, among others, to process your home loan.

Why should you receive this document before making your monthly mortgage payments?

Since a real estate property is one of the biggest purchases in your life, you as a segurista homebuyer should secure all the documentation you will need as you go along in the homebuying process. Having proper documentation reduces your risk in getting scammed and ensures that the terms are met.

What’s the difference between the Contract to Sell, Deed of Absolute Sale, and the Condominium of Certificate Title?

The Contract to Sell is merely a prelude, but is the basis for, the actual Deed of Absolute Sale. The Deed of Absolute Sale is a separate legal document which signals that all conditions stated in the Contract to Sell has been met with properly. The document is also proof that the sale has really transpired between the homebuyer and the seller (via the broker/agent or directly through the developer).

The Condominium of Certificate Title is issued in the final stage of the homebuying process. For condo unit homebuyers, the legal document signifies that ownership, including rights (e.g. the right to vote in homeowner association meetings), have been transferred from the seller to you.

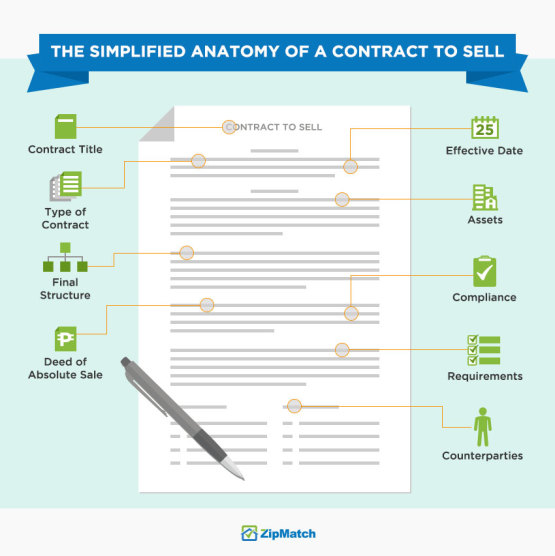

Parts of a Contract To Sell | ZipMatch

1. Contract Title

All property purchase contracts are titled as “Contract to Sell.”

2. Effective Date

Usually, an effective date is set the moment the contract has been signed by all parties.

3. Type of Contract

This section first identifies the parties involved in the contract (homebuyer and the seller), and the general agreement terms (which is you agreeing to buy the property from the seller).

4. Assets

This is where a homebuyer can find the full details of the property being sold to you (e.g. technical description of the condo unit, exact location), including conditions if you intend to make any upgrades or modifications to the original property unit.

5. Financial Structure

This section discusses how the property will be paid as agreed in good faith. It usually includes payment terms, schedule of payment, miscellaneous costs associated with the purchase, and other monetary obligations.

6. Compliance

This section dictates the things the homebuyer and the seller should need to fulfill to avoid rendering the contract null and void. For example, you as the buyer needs to make sure that you pay the right amount on time until the balance has been fully paid. As for the seller, he needs to make sure that the he has the legal right to sell and transfer the property to you without restrictions except full payment.

7. Deed of Absolute Sale

This section indicates what legal documents will be turned over after the homebuyer has paid the balance, including the Deed of Absolute Sale.

8. Requirements

This section describes the obligations, warranties (guarantees or promises) or exceptions needed to be fulfilled by both parties.

9. Counterparties

The homebuyer and the seller (or an authorized representative of the seller) will need to affix their signatures in the section to signify agreement between two parties. As counterparties, you are both exposed to a financial risk if ever the contract has been terminated or cancelled for any reason (e.g. fraud).

Contract to Sell Legal Jargons | ZipMatch

1. Witnesseth

The term means “to take notice of.” This section is basically a legal summary describing the agreement between the seller and homebuyer.

2. Possession

This section defines the seller’s accountability for the property upon completion of its construction. As such, inspecting the property using a punch list during turnover is essential to ensure that the homebuyer will not be handed over with a substandard property.

3. Restrictions

This section states that the homebuyer is subject to the terms stated in the deed plus the rules of the property management and homeowners’ association. The restrictions are usually pertaining to the use of the property other than its intended purpose.

4. Assignment

This section addresses a situation wherein you, as a new homeowner, need to sell the property to a different person. This provision normally requires you to pay a fee before the seller allows you to transfer the Contract or property rights and interests to another buyer.

5. Default on monthly payments

This section dictates what a seller would do in case the homebuyer fails to pay the mortgage payments on time. It also discusses the financial risks a homebuyer faces when making payments through a representative (real estate agent, broker), and what you should do to protect yourself from scams.

6. Other grounds on contract cancellation

This section lists the following reasons a court will relieve both the seller and the homebuyer of their obligations under the contract if it’s cancelled due to fraud or other grounds in compliance with Republic Act 6552 or the Maceda Law (as amended by Presidential Decree No. 957).

For homebuyers who have made two years of installments but choose to no longer proceed with the home purchase, they can either look for another buyer to sell their interest or get 50% of total payments made reimbursed from the seller.

7. Joint and Solidary Obligation

If there are more than one home buyer in the said contract, the buyers are either proportionally liable (joint) or fully and completely liable (solidary) for the payment of the property. The seller may either pursue one or both of the signees in the contract if ever there is default on payments.

8. Supervening Events

This section explains that the seller may choose to increase the purchase price of the property during the contract term in case of an economic event. It argues that a downturn in the economy would decrease the value of the said property. Since the purchase has yet to be completed, the seller would likely incur loss. This right does not exist in full, one-time home purchases. This section will have the homebuyer agree to pay the price adjustment in full or in accelerated payments.

9. Remedies

Remedies are the manner on how a seller should be given relief or compensation if the homebuyer breaks the terms of the agreement. It can either come in a form of a penalty, or a court order to enforce a homebuyer to comply to the contract terms.

10. Mortgages

This section protects the money a homebuyer will loan from the bank for the property purchase. The section will insist that no loan will be released unless you have been notified and that the Condominium of Certificate Title should be issued once you have paid the loan in full.

11. Assignment of Contract

This section protects the homebuyer’s rights in case the seller transfer his rights and obligations under the contract to another person. This stipulation will have the new seller bound to honor the terms in the contract.

12. Condominium Corporation

This section details your rights as a unit owner under a condominium corporation. Buyers who have fully paid for their condo units or have been authorized to occupy the units (and pay the respective association fees) are considered members of the condo corporation, and will have interest equal to the respective share.

13. Indemnity and Attorney’s Fees

This section dictates the kind of compensation the seller receives if his rights are violated by the homebuyer. In some cases, the homebuyer is obligated to shoulder legal costs, including the seller’s attorney’s fees.

14. Venue

This section dictates where and which courts to bring any legal action to if you or the seller need to interpret or implement a term in the contract.

15. Entire Contract and Alterations

This section insists that both the seller and homebuyer will not be bound by any agreement that is not in the Contract to Sell. If there are any changes or alterations made in the original agreement:

- Changes should be in writing;

- These written changes should be added in the contract as a supplement or postscript, and;

- The amended contract should also be signed by both parties.

This section also covers guarantees or promises (called warranties) made by the real estate agent or representative of the seller. Unless it is specified in the contract, the seller is not bound to the warranty made by the agent to the homebuyer.

16. Separability Clause

This section states that you will agree that any clause in the contract that would be invalidated by a governing party (ex. legal court, Housing and Land Use Regulatory Board) in the future will not affect the validity of the remainder of the contract.

Still got questions about your obligations as a homeowner? Don’t sign that contract yet and ask your condo management these questions first.

Like What you've read?

-

ches

-

Rizza Estoconing Sta Ana

-

-

famousa

-

Rizza Estoconing Sta Ana

-

-

MAE

-

Rizza Estoconing Sta Ana

-

MAE

-

Rizza Estoconing Sta Ana

-

MAE

-

Rizza Estoconing Sta Ana

-

-

-

-

-

Darcee Legayada

-

Pepper

-

-

Rizza Estoconing Sta Ana

-

Pepper

-

Rizza Estoconing Sta Ana

-

-

-

yoyo

-

Divine Buhain

-

Ellen Suniega

-

zipmatch

-

-

karla