You, too, can have the means to have your very own home.

Even if you’re a low- or middle-income Filipino, you, too, can afford to build or buy your own home. The government-mandated Home Development Mutual Fund, more popularly known as the Pag-IBIG Fund, gives its contributing members the power to finance their home purchase at a more affordable rate, as compared to the rates offered by real estate developers and banks. So you don’t have to worry about facing high interest rates and paying high amortization every month.

Who are eligible?

First, let’s specify who are eligible to apply for the Pag-IBIG housing loan. According to Pag-IBIG, members who satisfy the following requirements may avail of the housing loan program:

What can you purchase with your borrowed money from Pag-IBIG?

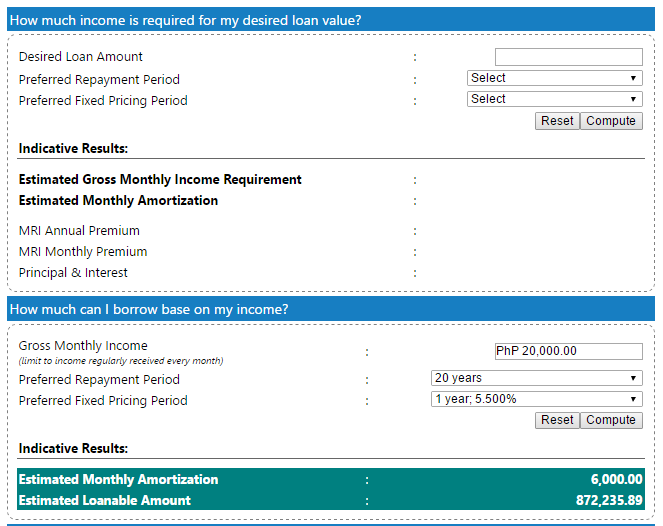

The Pag-IBIG Fund allows its members to borrow a maximum loanable amount of P6 million, with interest rates varying from 5.5% to 10%. The loanable amount depends on the member’s capacity to pay. If you want to know how much you can borrow based on your income and preferred repayment and fixing periods, you can check out Pag-IBIG’s housing loan affordability calculator.

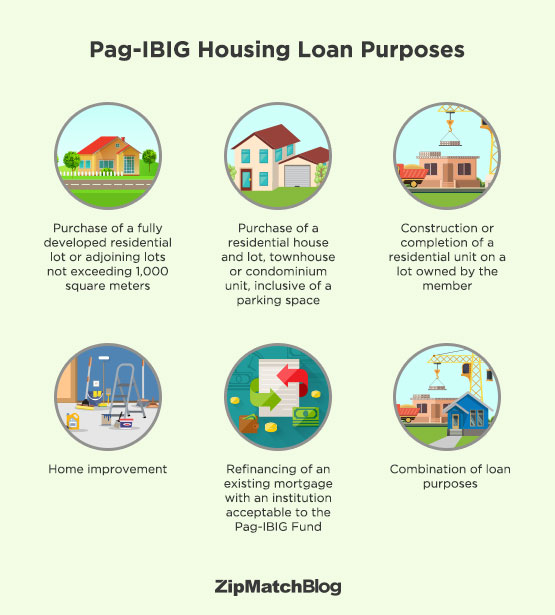

Now, the good thing about the Pag-IBIG housing loan is that can be used to finance not only your house and lot, townhouse or condominium purchase and construction but also even your home improvements.

Pag-IBIG members who qualify for the housing loan may use the money to finance any of the following:

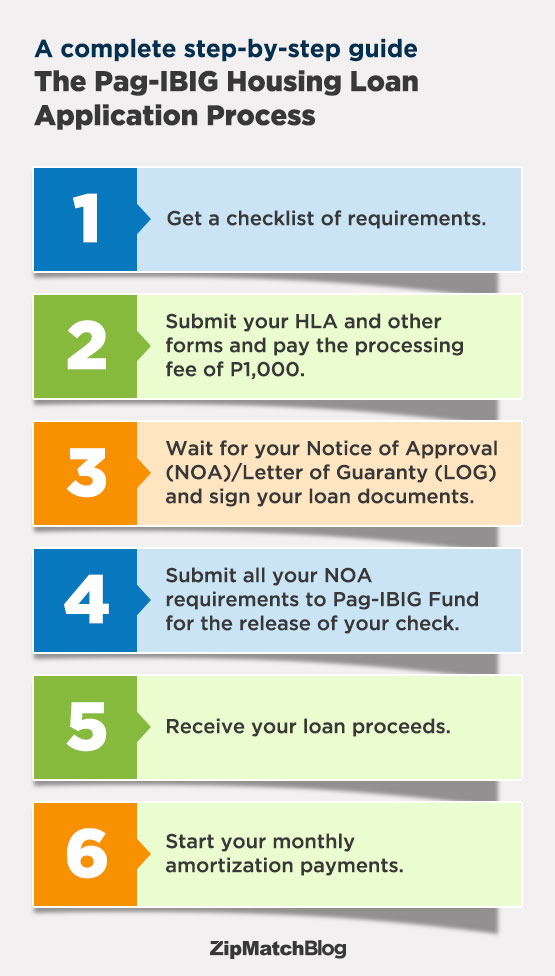

A complete step-by-step guide

Now that we’ve finished discussing who are eligible to the loan and where you can use the borrowed money, here’s a complete step-by-step guide on how you can avail of the Pag-IBIG Housing Loan to finally purchase that dream home of yours.

1. Get a checklist of requirements.

The checklist of requirements depends on the purpose of the loan. You may get your checklist online, or at the Servicing Department, 2nd floor, JELP Business Solutions Building, Shaw Boulevard, Mandaluyong City (for NCR account) or any provincial branch office (for provincial accounts).

Basic requirements include:

Borrowers over 60 years old and members availing of P2-million to P6-million loans also need to submit a health statement form (medical questionnaire).

2. Submit your HLA and other forms and pay the processing fee of P1,000.

You may submit your HLA with complete requirements at the Pag-IBIG Fund’s main branch and provincial offices. You may also file your housing loan application online. Upon submission of all requirements, you also need to pay a non-refundable processing fee of P1,000.

3. Wait for your Notice of Approval (NOA)/Letter of Guaranty (LOG) and sign your loan documents.

The NOA will be released only to the borrower or, for OFW borrowers, to the attorney-in-fact. If an application is not approved, the borrower will receive a Notice of Disapproval instead. Upon receipt of your NOA, sign your loan documents and submit within 90 days.

4. Submit all your NOA requirements to Pag-IBIG Fund for the release of your check.

You have 90 calendar days to accomplish all your NOA requirements, which include going to the following:

5. Receive your loan proceeds.

To get your loan proceeds at the Pag-IBIG Fund, you need to bring at least 2 valid IDs and show the following documents:

If you will not be paying your loan through salary deduction, you also need to bring 12 postdated checks.

6. Start your monthly amortization payments.

You’ve already had an idea on how much your monthly amortization payment will be using Pag-IBIG’s housing loan affordability calculator earlier, right? So you should be ready to pay that amount promptly. You wouldn’t want to face the risk of having your housing loan cancelled or foreclosed.

Have you experienced applying for the Pag-IBIG housing loan to purchase your dream home? Share with us your experience by leaving a comment below!

Like What you've read?

-

Jose B. Flores

-

Ahnjhela Tilam

-

Kay Sie