Philippine real estate is still looking good. Powered by an exceptional economic growth in 2013, the market is expected to outperform yet again this year, according to research presented by Colliers International.

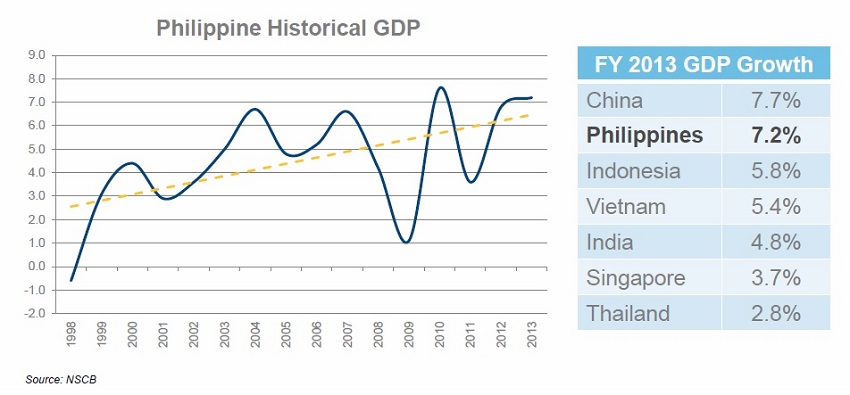

Despite analysts’ wary expectations after Typhoon Haiyan hit the country late last year, the Philippine economy grew 7.2 percent year-on-year to 2013. This was the highest in the last two years, the highest in Southeast Asia, and second only to China’s 7.7 percent.

Expanding Into Its Second Decade

During the presentation of Colliers International’s Philippine Property Market Report for the First Quarter of 2014, managing director David Young said:

We are well into the second decade of what has been a very prolonged expansion.

Young noted that aside from the usual demand drivers, new ones are fueling the economic growth, including a 15–20 percent annual increase in foreign tourist arrivals in the country and the gaming-related industry. The last, he said, will “dramatically change” the economy in 5–10 years.

Julius Guevarra, research and advisory director at Colliers, said the slowdown caused by Typhoon Haiyan caused a lot of analysts to adjust their 2014 forecasts downward. However, Guevarra said the 2013 fourth quarter data had changed their mind to paint a “more rosy” picture.

Services was the key driver for last year’s fourth-quarter growth, contributing 55 percent to the Philippine GDP. However, financial intermediation, trade, real estate, renting, and business activities also supported this growth. OFW remittances likewise helped, growing by 6.4 percent from 2012 to $22.8 billion.

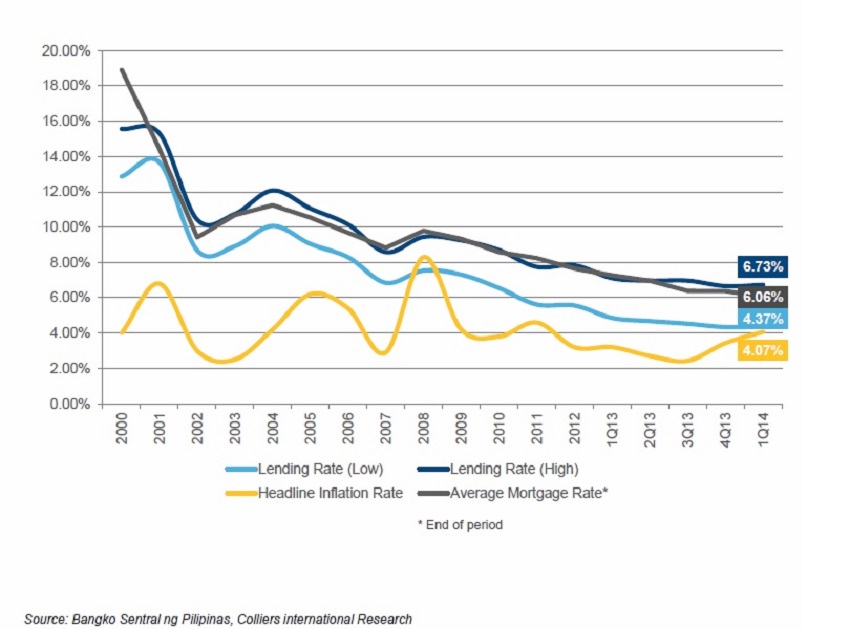

Although inflation rate also increased for the first quarter of 2014 by 4.1 percent, it didn’t stop consumption, given lending rates are at their lowest levels of 4.4–6.7 percent. Guevarra said that the average lending rate—

the pillar for the economy in general, for real estate in particular,

he noted—was stable enough, though it did make slight adjustments. And according to a survey of banks, he said the mortgage rate also made slight adjustments by averaging around 6.1 percent.

Office Real Estate Needs More Space

The office real estate is doing better than residential real estate. Vacancy rates increased by 1.9 percent this quarter in Makati City due to some non-renewal of leases and the recent turnover of the V Corporate Center. However, the demand is still high vis-à-vis the supply of office space.

Guevarra noted the demand for office space is still strong with 5 percent coming just from the BPO sector. This is not surprising as the BPO industry had already generated a million jobs in the last decade and has generated revenue of $18.1 billion as of the first quarter of 2014. Young said:

Developers are simply not building enough commercial real estate for the BPO sector.

Because of this, more offices are being developed at the fringe cities (like Quezon City and Pasay City) of the traditional business districts (i.e., Makati, Fort Bonifacio, and Ortigas) as developers seek to give companies more options. As an example of this demand, Guevarra pointed out the rise of asking rates in office space in Mandaluyong by 5.02 percent.

With regard to real estate loans, Guevarra said,

Nonperforming loans are actually the lowest in five years, about 2.81 [percent] in relation to real estate loans and based on total loan standings of 0.51 percent.

He added this is quite stable. On the other hand, he said developers and property owners are taking more commercial real estate loans as opposed to residential real estate loans, the former taking up 60 percent of total real estate loans.

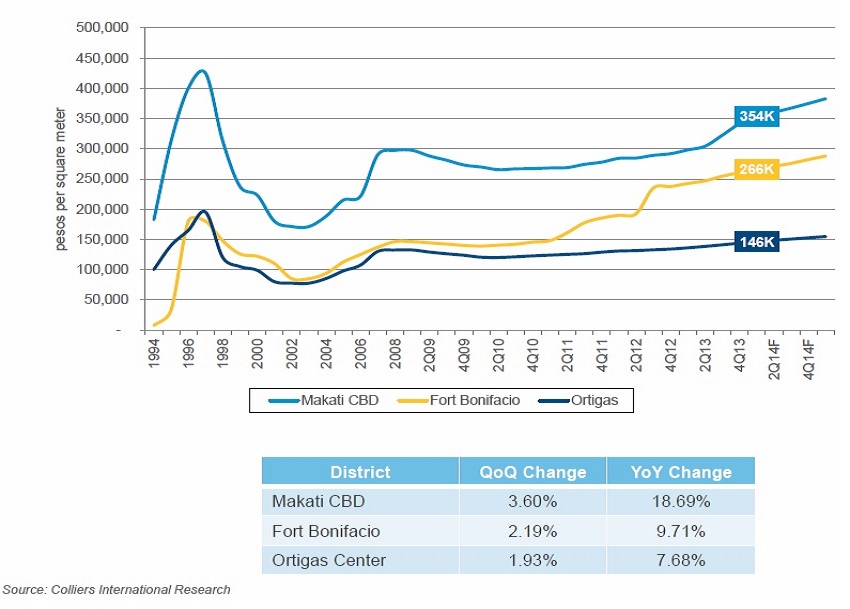

Land values among the cities went up, with Makati at the top with 3.6 percent in the first quarter of this year (or an annual 19 percent). Fort Bonifacio had a “slower” growth with 2.19 percent (or an annual 9.7 percent). Ortigas improved slightly with 1.93 percent (or an annual growth of 7.7 percent).

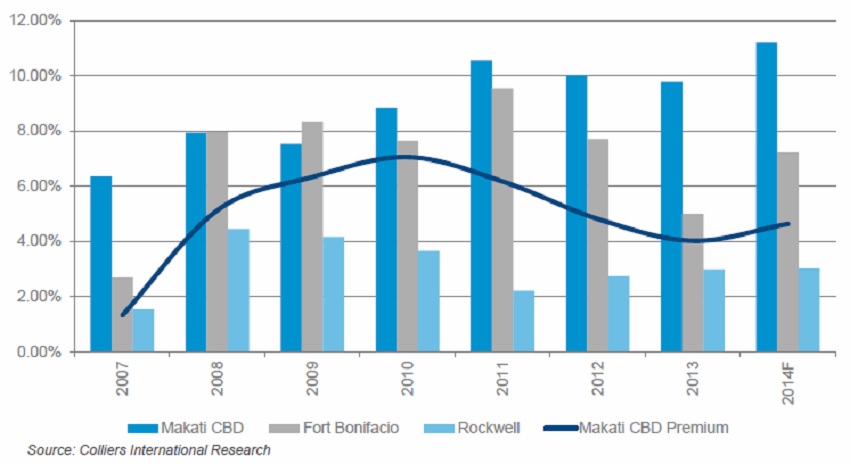

Guevarra said there will be no change in their forecast for office supply within the next few years in Makati, Fort Bonifacio, Ortigas, and Eastwood. However, he added that even with a forecasted slight increase of 3.2 percent by the end of 2014 and the lack of developable lands in the offing,

we still think that vacancy rates will remain low.

Adjustments in the Residential Real Estate

On the other hand, the high-end residential real estate is currently making corrections, what with 20 new residential condominiums being delivered this year and a 38.6 percent decline of licenses to sell issued by the HLURB. The latter is due to the lack of launches in the first two months of this year as opposed to the surge in the last quarter of 2013.

With the increase in supply of residential condominiums, vacancies are also starting to rise among smaller condo units (studios and one bedrooms). What’s more, the supply is forecasted to rise in the next three years. However, the premium three-bedroom units are currently enjoying almost full occupancy.

Guevarra said:

A correction is [ongoing] and I would think that the main concern would be the affordable segment [of the residential real estate].

Right now, HLURB licenses to sell for socialized and low-cost housing is up by 17 and 23 percent, respectively. This is because developers are starting to take advantage of government incentives by producing socialized housing units in exchange for value-added tax exemptions.

Changing Face in Retail Real Estate

There is an influx of supply of retail space even as developers look into other possible real estate products. Because of the ongoing renovations in mall spaces, vacancy rate increased by 1.5 percent in the first quarter of 2014 in Metro Manila.

However, Colliers expect rates to go back to its high 99 percent occupancy level, what with the strong interest of foreign brands to operate in the country and the lure of the increasing purchasing power of consumers.

However, research analyst Romeo Arahan noted a change in developers’ behavior with the development of small retail areas in residential areas, smaller configurations of retail areas, and the “formalization” of retail activities like public markets as they’re forced to offer quality products normally found in malls.

As an example, Arahan cited as example the development of City Mall by Double Dragon Properties, a joint venture by Jollibee Food Corp. and InJap Land Corp. (of Mang Inasal fame), and is set to open their malls in second- and third-tier cities in Visayas and Mindanao.

Arahan explained this is because developers are now exploring other real estate products that address niche or segment markets in order to sustain their projects for the next few years.